What is

Bitcoin?

Bitcoin in simple terms is software that creates a digital-only currency. There’s no physical currency and no actual coin that you can hold in your hand. Unlike fiat currency, Bitcoin is decentralized digital currency created, distributed, traded, and stored with the use of decentralized ledger system, known as a blockchain. It is decentralized, there’s no government, bank or company in charge of its management that can alter its supply.

It’s whole system is protected by heavily peer-reviewed cryptographic algorithms like those used for online banking, but unlike in banking cannot be altered. In the current monetary system, banks and governments control the spreadsheets. Banks give us permission to pay John. But do we need this central authority intervention? The crypto community says no. The goal of cryptocurrency is to maintain a globally-shared copy of this spreadsheet that cannot be altered or defrauded. Bitcoin is cryptographic, irreversible, distributed, and public. Unlike a bank where data sits on a centralized database, vulnerable to a single point of failure, bitcoin uses the blockchain that stores these irreversible transactions throughout the entire world-wide network. Bitcoin is the safest and most secure decentralized secure network in the history of man.

Brief History of Bitcoin

Satoshi Nakamoto, whose October 2008 white paper “Bitcoin: A Peer-to-Peer Electronic Cash System” described a framework for what would become bitcoin. Bitcoin was launched in 2009, and since then every Bitcoin transaction that’s ever occurred is recorded on the blockchain. The blockchain is a distributed ledger, similar to a spreadsheet. It is maintained and monitored by a decentralized network of tens of thousands of computers all over the globe. These monitors are called nodes. Nodes record the blockchain and validate new blocks that are added to the chain.

New transactions are bundled into blocks and added to the blockchain. In order to provide validity to new blocks, proof of work must be submitted that solves a difficult cryptographic equation. This process of this equation solving is called mining. The first miner to solve the equation is rewarded with Bitcoin. This mining process is the only way new minted Bitcoins are released into a finite circulation supply of 21 million.

Once Bitcoin is awarded, the process starts all over again and miners compete on solving the next block chain equation. Current block reward amounts to 6.25 Bitcoin per block, which occur approximately every 10 minutes 24/7.

Note, Bitcoin reward amounts are cut in half (halving) approximately every four years. Bitcoin halving imposes synthetic price inflation in the cryptocurrency’s network and cuts in half the rate at which new bitcoins are released into circulation. The rewards system is expected to continue until the year 2140, when the proposed 21 million limit for bitcoin is reached.

World’s largest Cryptocurrency

Bitcoin is the world’s largest cryptocurrency by market capitalization. In April 2021, Bitcoin hit a market capitalization of over $1 trillion dollars for the first time in its history. Seven months prior Bitcoin’s Market Capitalization was sitting around $200 billion, a growth of over 500%.

Best performing Asset in 21st century

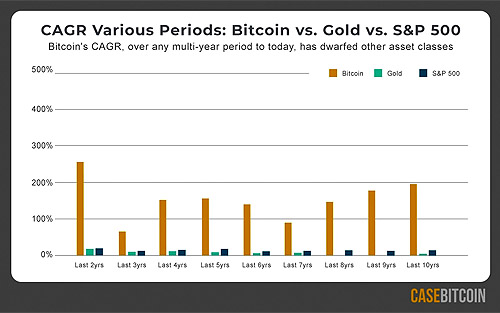

Bitcoin has been the best performing asset in the 21st century. Bitcoin has dwarfed all other classes and has a 197% compounded annual return over the last decade, which equates almost tripling your money every single year for the last 10 years.

Bitcoin as Digital Gold / Hedge Against Inflation

Bitcoin referred as digital gold because it improves upon many of physical gold’s characteristics. Not only is bitcoin scarce and durable, but it also is divisible, verifiable, portable, and transferable, all of which protect from the threat of centralization. Bitcoin is a store of value has built in deflation with a finite supply of 21 million. Supply cannot adjust to a higher demand or to higher prices.

In contrast, Gold is often touted as a way to hedge against inflation. Unfortunately, gold has not lived up to the hype. Its record has been spotty, according to historical data. An investment that hedges against inflation would generally rise along with the rapid growth in consumer prices. However, gold yielded a negative return for investors during some of the highest recent inflationary periods in the U.S. Investors worried about rising consumer prices may wish to consider other asset classes instead, according to Amy Arnott, a portfolio strategist at Morningstar. “Gold is really not a perfect hedge,” said Arnott, who analyzed the returns of various asset classes during periods of above-average inflation. There’s no guarantee if there’s a spike in inflation, gold will also generate above-average returns,” she said.

On the other hand, Bitcoin has built in deflation, only 21 million will ever be issued. Supply cannot adjust to a higher demand or to higher prices. As previously noted, Bitcoin is a scarce asset that is described by many as “Digital Gold” because it like Gold in that it can serve as a hedge against inflation. Some say its better than gold because Bitcoin’s supply is finite. The underlying supply is fundamentally limited by the protocol itself and limits the amount that can be mined through computers (miners – specific types of computers) across the globe (Bitcoin Network) approximately every 10 minutes 24/7/365.

Global Settlement Network

Bitcoin could become a settlement system for banks and businesses. Unlike traditional settlement systems, the Bitcoin network is global, it cannot censor transactions, and its money cannot be inflated by institutions like central banks. One of the key benefits is its ease of transfer. For a modest fee and a ten-minute cycle, you can move a billion dollars anywhere and its fully verifiable to the entire world.

Protection Against Seizure of Assets

Bitcoin is a uniquely seizure-resistant type of property. There is no amount of physical force or legal coercion that can transfer bitcoin from one party to another without the corresponding private keys. Bitcoin is strongest, most secure and most decentralized network of all crypto currencies.

Key Takeaways – Bitcoin is a Store of Value

Bitcoin is the first store of value in the history of man where its supply can never and will never be affected by any amount of its increase demand or price. There is a finite supply of only 21 million Bitcoin that will ever be available. It is decentralized, there’s no government, bank or company is in charge of its management that can alter its supply. It’s whole system is protected by heavily peer-reviewed cryptographic algorithms like those used for online banking. No organization or individual can control Bitcoin, and the network remains secure even if not all its users can be trusted. Using blockchain technology is the most secure digital network ever created in the history of man.

The Future of Bitcoin

Bitcoin is in its infancy. The early innings of a historical Technological Phenomenon. There is strong momentum in crypto adoption from Institutions world-wide, the momentum is incredible!

Follow the money and follow the smart people, the developers, the technicians, and BCR. Silicon Valley executives and engineers are leaving their cushy jobs at Google, Amazon, and Apple – some of which pay millions of dollars a year to chase what they see as a once in-a-generation opportunity. The team at BCR invites the investment community to join us in this exciting opportunity to rapidly scale this exciting growth CAPEX business model to help support the blockchain, a technology that will impact every business and almost every person across the globe. The train has already left the station and it cannot be stopped.